Which of these fraud scenarios is worse?

If you had to choose one of these, which would it be?

#1: A patient pays $100 for services rendered. Your employee steals the $100 and covers up the theft by recording a write-off of $100 on the patient’s ledger.

#2: Your fee is $500. Your employee collects $400 from the patient and then applies a $100 write-off on the patient’s ledger.

In both scenarios, the practice incurred a loss of $100.

So how are theses two scenarios different?

They differ because of who received the benefit of the employee’s financial misconduct.

In scenario #1, the employee’s actions, benefited the employee by $100.

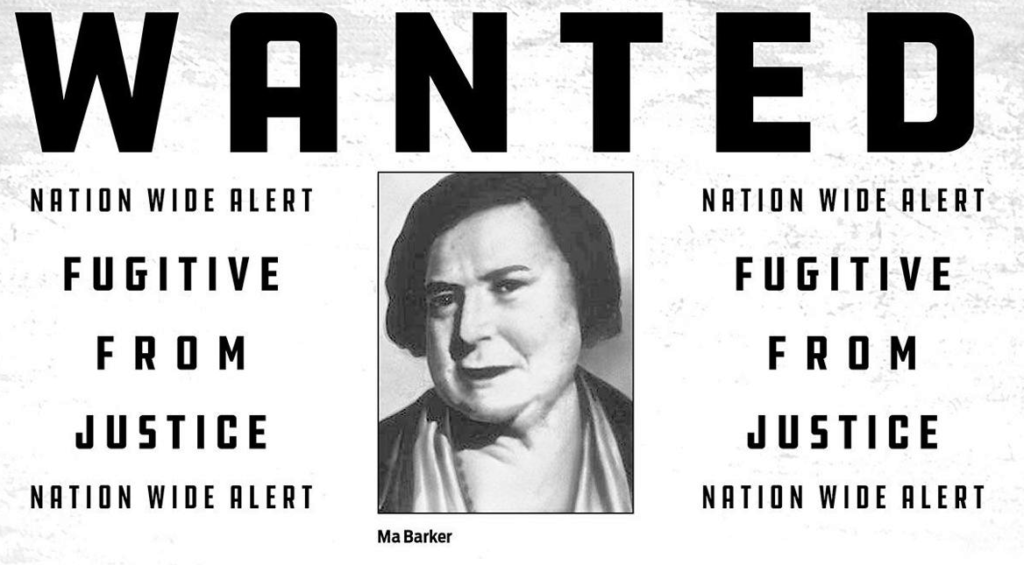

Let’s call this scheme “Ma Barker”

In scenario #2, the employee’s actions benefited the patient by $100.

Let’s call this scheme “Robin Hood”

To illustrate this difference further, let’s imagine a scenario where there are two dental practices.

One practice employs Ma Barker, and the other practice employs Robin Hood.

Now imagine that after a few years of employment, each practice discovers employee financial misconduct.

When the losses have been calculated, each practice learns they incurred a loss of $100,000. (and for the sake of illustration, lets say that each practice has $100,000 in employee dishonesty insurance coverage.)

Employee dishonesty in a Ma Barker case is straightforward.

In the Ma Barker case, the employee stole money to line her own pockets.

After an audit has confirmed the loss, the practice owner can claim for $100,000 against the employment dishonesty insurance

Employee dishonesty in a Robin Hood case is not so straightforward.

Unlike the Ma Barker case, where the employee stole for their own benefit, the Robin Hood case involves an employee who stole to give benefits to patients; and it is more common than you may think.

Why do some employees act like Robin Hood? What is in it for them?

Every employee that perpetrates a Robin Hood scheme receives some type of non-financial benefit.

Most perpetrators will say:

- it made my job easier:

- “I hated collecting co-payments”

- “I did not want call patients for money”

- it felt good:

- patients love Robin Hood employees, and Robin Hood employees enjoy compliments from patients. Yea, it does feels good.

In patients are often unaware that the Robin Hood cases, the patients are unaware or blind to the fact that the employee is ‘stealing’. All they care about is that the Robin Hood employee is nice to them, and never charges them for visits.

Robin Hood employees will often tell patients: “don’t worry if your insurance does not cover the full amount, I’ll make it work” or “I’ll reduce your payment by $100 so you will not have to pay more out of pocket”

These words are music to the patients’ ears, and that’s a big problem.

Robin Hood employees tend to foster and cultivate a culture of false insurance entitlement among the patient base.

Patients of a Robin Hood practice can have a history of never paying out of pocket, so when the Robin Hood employee is finally fired or has left the practice, and the replacement employee starts asking patients for payment; there’s a problem. The implications from this most often result in a negative impact on practice goodwill.

If you “catch” a Robin Hood employee, terminating their employment often requires special handling.

When a Robin Hood employee is fired, they often will vigorously defend their actions, claiming that the practice owner ‘told them to do it’.

Most Robin Hood employees believe they are not doing anything wrong. Some disgruntled Robin Hood employees have sued the practice for severance and wrongful dismissal and have won their case. (yes, this does happen)

Now that the Robin Hood employee has been fired or has left the practice, the practice owner decides to make a claim of $100,000 against the employment dishonesty coverage.

Bad news: only certain employee dishonesty policies will cover losses incurred by a Robin Hood employee. So you may not get your money back.

More bad news: the Robin Hood employee has left behind a culture of false entitlement amongst patients who were accustomed to not having paying out of pocket.

When the practice resumes proper billing for services, patients often begin to complain. In some cases, many patients may leave and go elsewhere for treatment.

Patients of a Robin Hood practice will often say things like:

“Why do I have to pay now? I never had to pay anything before!”

“Can’t you make my insurance pay for it. Jenny* always did that? ” (*Jenny being the name of the Robin Hood employee)

Lastly, unlike Ma Barker cases legal recovery and prosecution remedies are more difficult in Robin Hood cases. It can be an uphill climb to sue a Robin Hood employee, and most district attorneys will not have an appetite for criminal prosecution.

Because the financial loss in both Ma Barker and Robin Hood cases have the impact, if had to choose, I’d rather have a Ma Barker in my practice than a Robin Hood.