Your Front Desk Manager is stealing Frequent Flyer Miles. What would you do?

If this happened to you – what would you do?

The Front Desk Manager claimed she was doing nothing wrong.

When a patient paid with cash, the Front Desk Manager would pocket the cash and then use her own credit card to pay the bill.

This allowed her to collect Frequent Flyer Miles and other rewards on her personal card.

It also caused the practice to incur credit card processing fees; meaning the practice was losing about 2.5% on cash sales.

Cash payments in this practice were about $48,000 each year; so the practice paid over $1000 in unnecessary credit card processing fees.

This went on for several years unnoticed before the practice owner accidentally uncovered it.

When confronted, the Front Desk Manager said she was not stealing.

She explained that the because the practice started using direct deposit for insurance payments a few years ago, the bank deposit had “shrunk” to just a couple hundred dollars in cash collected each day.

Her explanation was that it was easier to charge her credit card and take the cash, than bringing cash deposits to the bank.

What would you do?

- start digging deeper. After all, who knows what else she may have been doing?

- fire her for financial misconduct?

- hire someone to audit your financials?

- take the cash and use your own credit card to pay so you collect the frequent flyer miles?

- reprimand your employee and keep a eye on her?

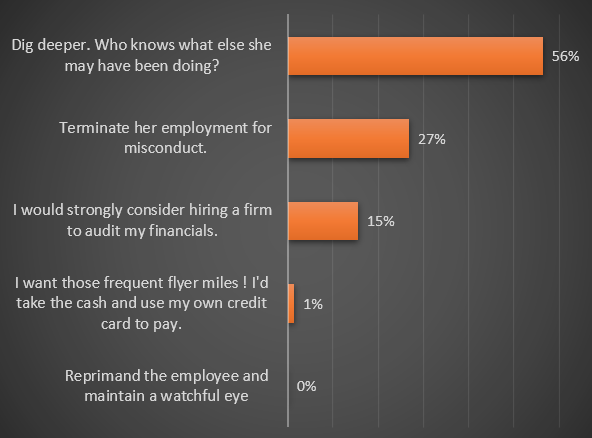

To find out what others would do, I conducted a survey of Dental FraudBuster group members on Facebook. The group link is here: https://www.facebook.com/groups/dentalfraudbusters

Dental FraudBusters Survey Results

“Dig deeper. Who knows what else she may have been doing?”

56% said they would dig deeper.

I think that’s a great idea, but the success of this will depend on the competency of the person who is doing the digging.

If you find yourself in this situation, you may need some help. Please don’t hesitate to contact me for some free advice. I will point you in the right direction or you can hire me on a limited basis to do some of the heavy lifting.

If “digging deeper” does uncover evidence of further financial misconduct, then it’s probably a good idea to consider a fraud examination / forensic audit.

“Terminate her employment for misconduct.”

27% (almost one- third) of respondents said they would fire the employee for misconduct.

Given that the employee was doing this to benefit herself, without the consent or authorization of her employer, then employment termination is a real consideration.

However, in such cases, it is important to properly document the misconduct and terminate the employment in accordance with employment law. Otherwise, you may find yourself on the wrong end of an employment lawsuit.

Related – see my article here: “I’ll just let her go. What could possibly go wrong?”

“I would strongly consider hiring a firm to audit my financials.”

15% said they would hire someone to audit the financials.

I’m in the business of conducting audits, so yes, I think that’s a great idea!!

On the other hand, audits can be expensive and to predicate an audit based solely on the circumstances described above is probably not the immediate next step.

My recommendation is to conduct a exploratory examination of the financials. In other words “dig deeper” to look for other evidence of financial misconduct.

“I want those frequent flyer miles! I’d take the cash and use my own credit card to pay.”

1% said they wanted the frequent flyer miles for themself!

This was a creative, and hopefully tongue-in-cheek response.

“Reprimand the employee and maintain a watchful eye.”

0% said this would be the best course of action.

Finally! Something we all agree on. :-)