How to Steal from a Dentist.

How employees steal from a dental practice.

Posted:

Last Updated:

This post discusses the schemes used by employees to steal from a dental practice. The schemes are not specific to dentistry and are used to steal from every profession and business.

I have uncovered these schemes countless time since 2004, and from that, I can say that most dental embezzlement is perpetrated using a handful of common schemes.

These embezzlement schemes are not “trade secrets” either.

All of them can found online and in the news. Visit this link to read hundreds of news articles about dental embezzlers and the schemes they used -> Find an Embezzler

BUT FIRST, LET’S BUST SOME DENTAL EMBEZZLEMENT MYTHS

“Over 300 ways to steal“

David Harris, CDA Essentials Vol2 #8:

https://www.cda-adc.ca/en/services/essentials/2015/issue8/#27/z

Download PDF

“Wait! Wuh? I’ve been conducting dental embezzlement examinations for over 20 years. From that experience I can state with complete confidence that there are not over 300 ways to steal from a dental practice. How is that even possible?” Bill Hiltz

Busting Other Embezzlement Myths

It’s a common myth is that “employees can only steal cash“.

This is perhaps supported by a false belief that checks, credit cards, and other forms of payment are “safe harbors”.

Fact is, dishonest employees can target all forms of payments

See a Typo or an Error? Report it.

Here are the most common ways to steal:

- stealing insurance payments (checks, virtual credit cards)

- stealing patient payments (cash, checks, credit cards)

- unauthorized credit/debit card refunds (to their own card)

- submitting fraudulent dental claims and stealing the payments

- issuing phony refunds to patients and insurance

- payroll padding – phantom employees

- credit card abuse

- check fraud

Add these to this list of stolen items:

- stealing rebates

- stealing dental supplies and then selling them online

- NO2 tank depletion (filling balloons with nitrous after hours)

- prescriptions / medications (anxiolytics, opiates)

- fraudulent Amazon orders – Click here Read More

- Stealing gift cards intended as incentives for patients – the office manager ordered $30K in gift cards in one year. She kept $25K of the gift cards for herself and gave $5K to patients.

- stealing office equipment

- stealing from other employees and patients

..and some dishonest employees kept on stealing after they were gone.

- One dental embezzler made the practice pay for her health plan for a full year before it was caught.

- Another embezzler stole during her employment and after. Six months after her employment ended, the ex-employee set up an automated monthly withdrawal of $600+ from the dentist’s bank account. It took many months before the practice owner noticed the ACH withdrawals. When he contacted the bank, they refused to reimburse the dentist for any unauthorized withdrawals greater than 30 days.

- An ortho manager stole dozens of postdated checks for monthly ortho payments and then suddenly quit. Three months later, she began cashing the checks. The orthodontist was tipped off when a patient complained that the office had cashed 3 of her monthly ortho payment checks all at once.

How to steal from Patients and Insurance Companies

When a dishonest employee decides to steal a payment, they often use one or more of these methods to conceal their theft .

Deleting Transactions

I’ll use cash in this example. Cash is easy to steal, easy to conceal and every dishonest employee will take cash from the practice at some point.

(Side-note: the amount of cash that a dental practice collects is idiosyncratic to the patient base. Some offices collect less than 1% of their total revenue in cash, others as much as 70%. For most general dental practices, the amount will fall between 2% and 6%)

Here is an illustration of a typical cash scheme:

- the patient has finished treatment and is at the front desk.

- the employee informs the patient there is a balance owing

- the patient makes a cash payment and the employee records the payment in the dental software

- the employee prints a receipt and hands it to the patient

- the patient leaves

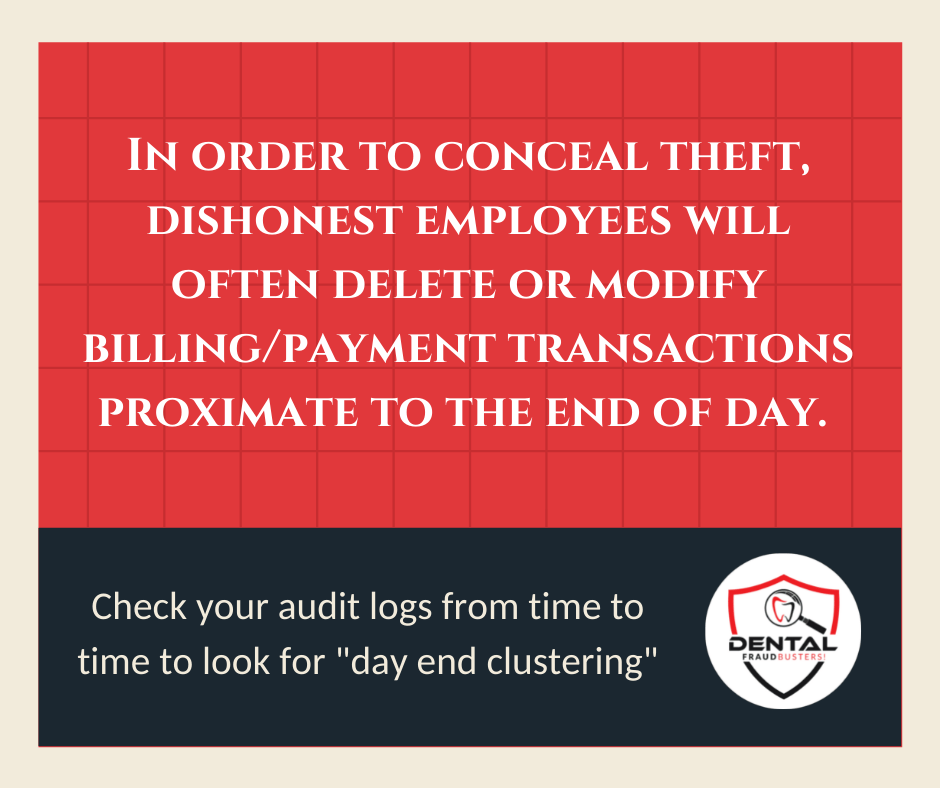

After the patient has left, the employee deletes the original cash payment from the software and pockets the cash.

To conceal this theft, and to make the patient’s account appear in balance, the employee will do one of these things:

- delete the underlying treatment charge, or

- apply an unauthorized adjustment to offset the treatment charge, or

- back-date the original payment

looking for DELETED AND BACKDATED transactions

Your practice software management software has an audit log which can help you identify deleted payments, deleted treatments, and backdated records.

That said, most dentists find Audit Trail reports difficult to understand.

That is not surprising. It takes time, effort and regular use to become proficient in interpreting the various events recorded in the audit trail.

Why is an Audit Trail so important?

The Audit Trail is a valuable tool for detecting discrepancies in billing and payment entries, and uncovering instances of fraudulent activity within the office.

The audit trail tracks modifications, deletions, and date changes made to patient and financial data, as well as changes to appointments, and provider allocations.

In essence, the audit trail can help to identify whether a financial discrepancy was the result of an unintentional human error, willful neglect, or malicious intent.

When you see a deleted or backdated payment, begin by asking yourself if there may be a reasonable explanation. I do not recommend confronting the employee to look for answers, that may worsen the situation.

If you need help, most dental software companies offer online videos and manuals to help you better understand what is in the audit log.

If you have questions about your audit trail, feel free to drop me a line.

spot check for phantom adjustments

Dishonest employees can apply offsetting ‘phantom’ adjustments to patient ledgers to create the illusion of balance. They often will choose a frequently used adjustment to conceal their theft. (i.e.: enter a fictitious adjustment instead of the actual payment)

For example, in a PPO practice that accepts insurance reimbursement, it is common to see legitimate writes-off of non-covered services using various codes such as “Insurance Adjustment” or “Insurance Write-off”. Over time, there will be hundreds of legitimate adjustment recorded in various patient ledgers.

But because the legitimate adjustment code is ubiquitous in the reports, it will be less likely for a fraudulent adjustment to stand out amongst the hundreds of other legitimate adjustments.

Credit adjustments such as “Professional Courtesy” or “Seniors Discount” may be used less frequently by a dishonest employee since it may draw unwanted attention from the owner. (i.e.: a seniors discount applied to a Gen-Y (millennial) patient account will stand out)

writing OFF OLD UNPAID BALANCES

Fraud experts agree, the more authority a person has, the more damage they can do.

Employees should not be permitted to write-off unpaid accounts. The office should have a written policy regarding write-offs with all write-offs approved by the practice owner on a monthly basis.

Stated differently, what’s to stop a dishonest employee from pocketing a long overdue payment when the employee knows the patient may never return.

Take the case of Kyle.

Kyle owed the practice $800 for well over a year. The office manager has sent monthly statements, with no success.

Then, one day, “out of the blue” Kyle walks into the practice to pay his bill. Kyle apologizes for being so late with his payment and tells the office manager he has been out of work for a long time and is relocating for a new job out-of-state.

Kyle pays his bill by credit card and leaves. The office manager knows that Kyle will not be returning to the practice, so she deletes the credit card payment from Kyle’s ledger, and replaces it with a write-off. Then, she refunds $800 to her own credit card.

At day end, everything appears in balance and the office manager feels confident that the practice owner will never question the write-off on an old unpaid account.

Back-dating is one of the oldest schemes AND still used today.

Here’s how backdating works:

As an illustration, a patient’s ledger shows there was a visit and charge entered on on March 1, and the patient paid the account balance in full on March 20.

Looks legit – or is it?

With backdating, this is what really happened.

The patient was charged on March 1 but paid the account on March 26. (the patient did pay on March 20 as the ledger shows)

The dishonest employee back-dated the patient payment for March 26 to make it appear as though it was paid six days earlier on March 20.

The employee pocketed the payment and because of backdating, the payment did not not show up on the normal day end report for March 26.

See a Typo or an Error? Report it.

Cash payments are usually stolen on the same or next day.

Patients who pay in cash usually do so after their appointment has ended and before they leave the practice.

If the patient’s appointment was over at 11:00am, then we should expect to see a cash payment recorded proximate to 11:00am (5 to 10 mins after the appointment ended)

If your audit log shows cash payments being recorded at times long after the the appointment has ended, this may be a sign of “cash holding”.

This happens when an employee sequesters cash payments during the day and then later decides how much cash they can steal without getting caught.

SUBMITTING FALSE insurance CLAIMS.

Dishonest employees will can also steal from insurance companies to line their own pockets (but not all steal for themselves)

Here is a common scheme.

The employee creates a fake a dental claim for treatments that were not rendered, and submits the claims it the insurance company for reimbursement.

When the insurance check arrives in the mail, the employee converts the check to cash by one of two methods.

They deposit the check into the dentist’s account and at some time, remove an equal amount of cash (substitution scheme) or the check is deposited into the employee’s account (depositor forgery).

Despite the check being payable to the dentist, an employee can convert the check to cash by depositing the check directly into their own bank account through an ATM.

Sometimes, an employee will collude with a patient (most likely a friend or family member) to steal from the insurance company.

The employee sends in fraudulent claims and the insurance checks mailed to the patient. The patient cashes the check and then shares the proceeds with the employee.

“One of my first cases involved collusion between an employee and a patient. The employee submitted fake claims for the patient’s family and the checks were mailed to the patient . The insurance company paid $43,000 to the patient for work that was never done. The employee cashed the checks and split the money with the employee.”

William Hiltz

Stealing insurance CHECKS

Dishonest employees can also steal insurance checks for work that was actually done and deposit the checks into their own account.

Many practice owners find this hard to believe, yet I see this all the time. Want to see how easy it is to steal insurance checks?

Watch the video of Arica Cameron who stole $600,000 in insurance checks and deposited them into her Wells Fargo account.

DEPOSIT TAMPERING

In every dental office, someone must physically take the cash and checks* to the bank. This person will have an opportunity to take a portion of the money before it is deposited into the dentist’s account.

*practices that use check scanners for remote deposit make fewer trips.

Separation of function will reduce the risk of deposit tampering. In this example, someone is assigned to prepare the bank deposit slip for the bank and a different employee is assigned to make the physical deposit. The employee who made the deposit keeps a copy of the slip which is matched to a receipted deposit slip issued by the bank when the deposit is made.

Separation of function is designed to prevent deposit tampering but thefts still occur because the process is not adhered to.

In many dental offices, a single person oversees preparing the deposit slips, making the deposit, and reconciling the bank statement. That person can steal money and conceal it by falsifying the deposit slips.

To illustrate, if a dentist was paid $1,000, and the employee filled out a deposit slip for $500 and stole the other $500. The employee also made corresponding bogus entries to understate the day’s receipts.

Again, the embezzler’s goal is to create a false sense that everything is in balance.

The best way to deter this kind of fraud is to separate the functions of preparing the deposit and making the deposit.

Stealing from the dentist’s deposit will be difficult to conceal for a long time if separation of function exists.

Deposit tampering can be successful for a long time when a practice owner has no interest in the business side of the practice and trusts one employee to look after all things.

MYTH: “safeguards are not effective”

Red flags can be significant in uncovering financial misconduct.

A staggering 85% of embezzlement cases involved at least one of the Top Six embezzlement red flags.

CLICK ON THE IMAGE TO TAKE THE ASSESSMENT

If you have questions, or need help in implementing any of the suggestions in this article, contact me for assistance.

Report an Error or Typo.

If you see an error or spot a typo, please let me know.

Send your comments directly to Bill Hiltz using the form below.