How a Simple Government Form Can Turn in Embezzlers

Frank Abagnale advises using Form 1099to turn in embezzlers to the IRS.

Frank William Abagnale Jr. is an American security consultant known for his career as a con man, check forger and impostor when he was 15 to 21 years old. In 1980, Abagnale co-wrote his autobiography, Catch Me If You Can, which built a narrative around these claimed frauds. The book inspired the film of the same name.

In the this video, Mr. Abagnale says filing a 1099 is one of the best options for those who have been affected by embezzlement, and he’s partly right in that turning an embezzler over to the Internal Revenue Service may result in restitution more quickly than taking him or her to court.

My advice? Skip the 1099

Do not use Form 1099-MISC or a W-2 to report an embezzler.

Why?

- W-2s are submitted to report compensation from work performed, and embezzling is not legitimate work.

and..

- Form 1099-MISC is intended to be used to report payments made to a “non-employee” for fees, commissions, prizes, and awards.

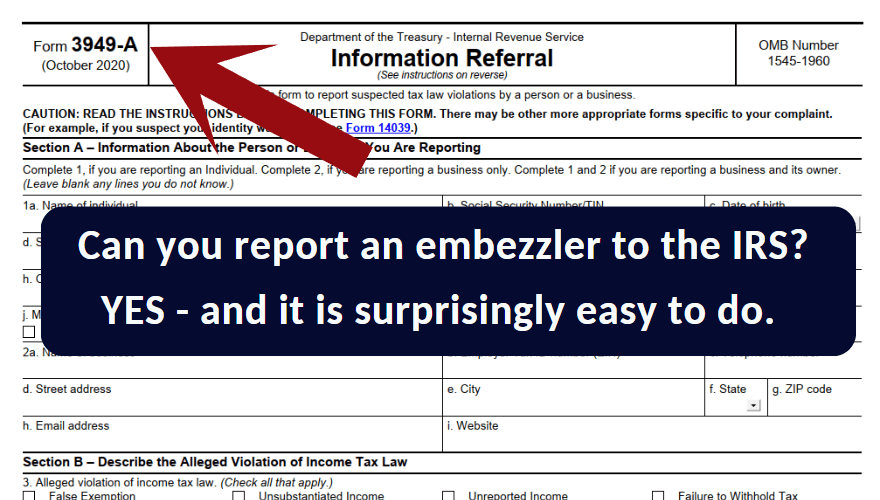

So, instead of using From 1099-MISC, I recommend you use Form 3949A. It’s a simple 1 page form that you can download here:

Have Embezzlement Concerns? Give me a call.

William Hiltz BSc MBA CET

Hiltz & Associates

and the creator of

Dental FraudBusters.