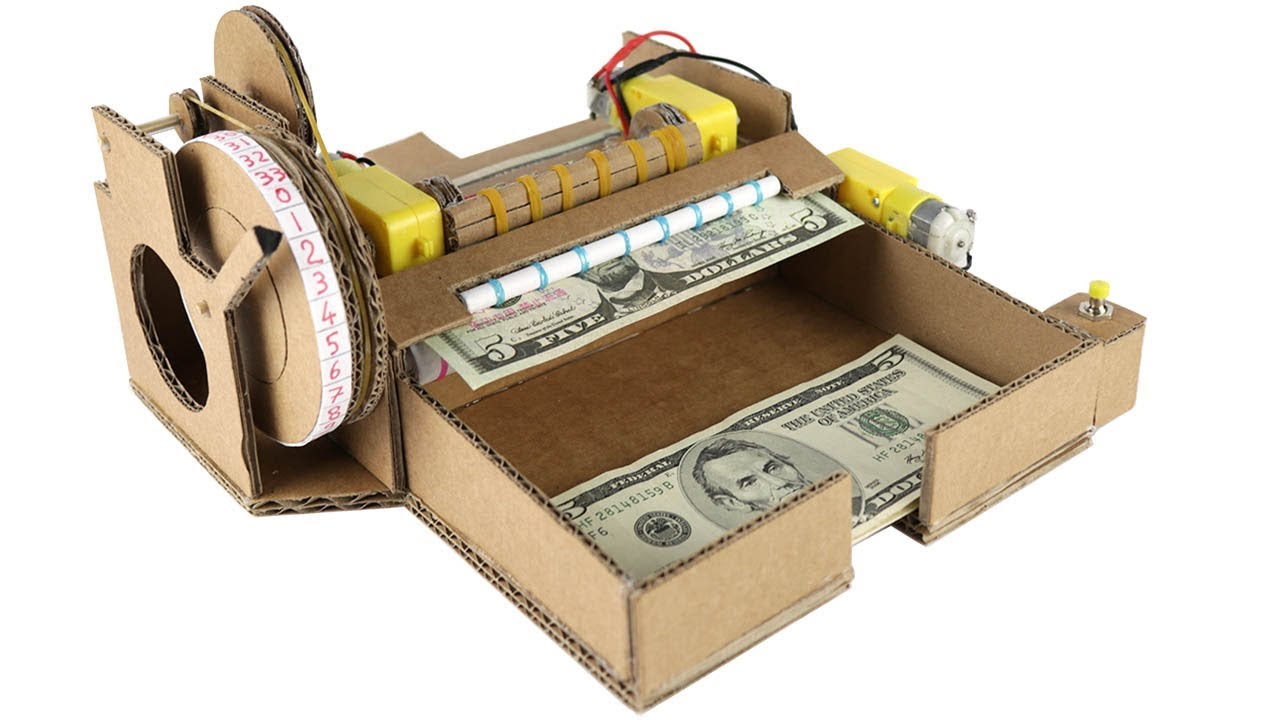

Need cash? Don’t use your practice as an ATM.

“It’s a pain the butt to bring cash deposits to the bank.”

Practices that receive EFT insurance payments and use check scanners to electronically scan and deposit checks can find themselves having to make less frequent deposits to the bank.

Moreover, when they need to make a bank deposit, it primarily consists of cash payments received from patients, and the occasional check that the scanner could not properly read.

Instead of running to the bank to deposit cash payments, some owners will take the cash themselves and then charge an equal amount to their personal debit card.

Example: if the practice collects $460 in cash payments from patients, the practice owner takes the $460 in cash and then pays $460 to the practice using their personal debit(or credit) card.

This may seem like a good idea. Everything “balances” and it saves a trip to the bank.

Actually, this is a really bad idea because:

- It shows your employees that your merchant terminal can be used like an ATM. This opens the door for employees to take cash and charge their personal debit (or credit) card for the same amount.

- To earn bonus points employees can take patient cash payments and charge their personal credit card for the same amount. (yes, this has happens more than you may think)

- It adulterates your financial records. Your practice management software collection will have a different composition that your bank’s deposit reports. This makes it difficult to separate the wheat from chaff when reconciling cash receipts. (and since dishonest employees often steal cash, it makes my job more difficult too)

Using your merchant terminal like an ATM to make cash deposits may invite other problems.

You can withdraw money from an ATM as well.

Read this post about using the merchant terminal for unauthorized refunds.

How to Get in Touch

Hiltz & Associates

and the creator of

Dental FraudBusters.