Dentistry is One of the Most Embezzled Professions.

It’s a fact, fraud sucks!

Widely published statistics show that 3 out of 5 dentists have been a victim of employee dishonesty during their career. In fact, embezzlement is so widespread in the profession that virtually every dentist will know at least one other dentist who was stolen from.

What is less widely known is that most dental embezzlers are first-time offenders who never intended to steal when they were first hired. They have no criminal history, lead relatively blameless lives, and appear as hardworking and loyal employees who have earned the dentist’s trust. My estimate is that 80% of dental embezzlers are “first-time” offenders who get caught and do not go on to re-offend.

In contrast, a serial embezzler is a someone with a previous history of stealing from another dental practice, and unlike the first-time offender, who did not intend to steal when they were first hired, a serial embezzler will begin to steal almost immediately. Most serial embezzlers never become a long-term employee as they tend to wreck a practice in just a few months before they are either fired or quit.

Many first-time offenders appeal to a higher loyalty to justify their stealing. (a “higher loyalty” relates to their desire to meet the various demands of their families, such as the needs of dependents, to help a relative in trouble with the law or remain in an abusive relationship.)

My belief is that under enough pressure most humans can be corrupted. From that, it’s no surprise to anyone when an embezzlement happens in a company where an employee was allowed to handle money with little or no oversight

The majority of first-time embezzlers will dutifully work in the practice for a few years, until an unplanned situation arises their personal life which creates an intense pressure for money. This pressure further motivates the employee to make a poor decision and begin stealing from the practice. Moreover, if the financial pressure becomes removed, they will continue to steal until they are caught or leave the practice. I have never encountered a full-time employee who became a part-time embezzler.

To hide their thefts, dishonest employees will manipulate billing and payment records, understate fees, conceal payments, delete records, and create phantom transactions. They will pocket cash, steal insurance checks, forge signatures, abuse credit cards, submit fraudulent claims, divert refunds, and the list goes on. The sad reality is, when an employee is motivated to steal from you, they will find a way to do it.

The most important goals of every embezzler are (i) steal money and (ii) do not get caught. To do that, they must conceal and hide the thefts from the dentist. To avoid suspicion, they often will create fictitious and alternate scenarios to explain things when the dentist asks questions.

As a result, an embezzler is always leery of being caught and “on constant alert”. Because of this, they often will begin to exhibit certain behaviors that are correlated with their dishonest activity.

Therefore, watching for employee behaviors that are consistent with fraud is a first sign that something may be wrong.

The Warning Signs of Employee Dishonesty

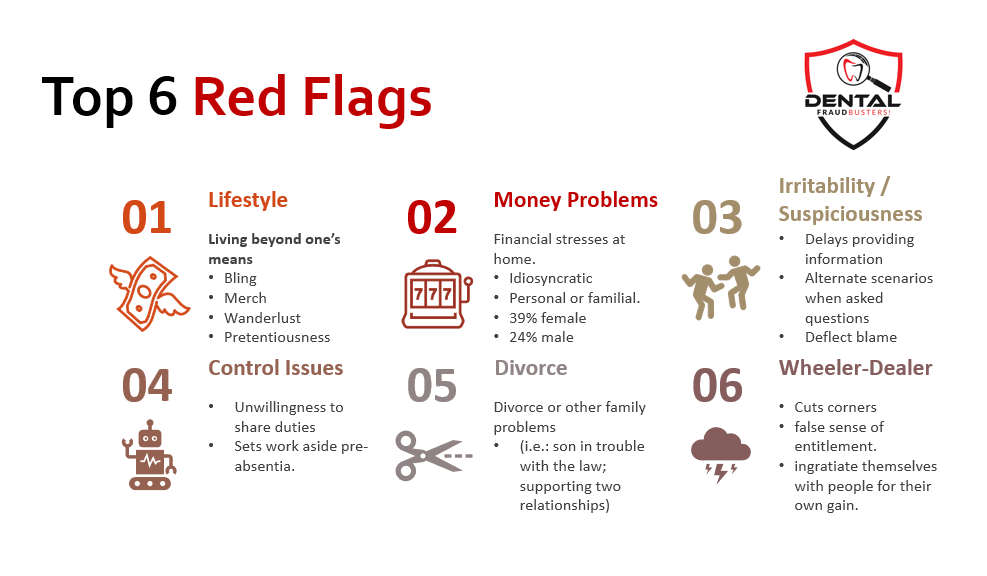

Employees who steal from their employer often display various behavioral traits associated with their fraudulent conduct. (a “red flag”) A red flag is an indicator that fraud may be present; but it does not guarantee its presence. There may be an innocent explanation, but it may also point toward something more sinister.

Recognizing and understanding these red flags can help practice owners dramatically improve their chances of detecting embezzlement early and minimizing their loss.

Here is my list of the top behavioral red flags to look for (and observed in 92% of embezzlement cases)

- Be aware of an employee whose lifestyle doesn’t add up, In 40% of embezzlement cases, the person stealing displayed a living standard disproportionate to their income.

- Look out for an employee who has visible signs of money problems. These employees may make comments or complain about not having enough money. The cause of their money problems may be visible or hidden. (getting collection calls while at work, large medical bills, spouse lost their job, divorce, etc).

- Be aware of an employee who spends a lot of time alone in the office by staying late or coming in early. Many dishonest employees will refuse to take vacation or refuse to stay at home when they are sick.

- Watch out for employees that are “jumpy” whenever someone tries to help them with their duties. Dishonest employees will resist the involvement of others in their work.

- Be aware of employees who exhibit “wheeler-dealer” behavior, such as cutting corners with patient or dental insurance charges. Most Wheeler dealers will exhibit a false sense of entitlement and will ingratiate themselves with you or others for their own gain.

- Be aware of an employee who is unreasonably resistant to change. They want things to stay the same and will object changes in practice management software, bookkeeping, accounting services, merchant service providers, or other services.

- Be aware that dishonest employees are often slow to respond to a routine request for information. The report that you asked for today may not show up on your desk until tomorrow. Dishonest employees will often appear to become annoyed when you ask reasonable questions about financial transactions or dental insurance claims.

Remember, most embezzlers “work very hard” to do things that make you believe that they are “on top of things”. This contrived appearance is essential as it helps the employee maintain the bond of trust with you that is required for them to keep stealing.

You should look for red-flag behaviors in your practice at regular intervals, and when a red-flag is observed, look for an explanation. (the author’s blog has a comprehensive and anonymous red-flag self-assessment for dentists)

Lastly, if your practice is embezzled, the first and best source of financial recovery is crime insurance. I recommend you check your business policy or contact your insurance agent to ask if you have “employee dishonesty” insurance.

Employee dishonesty insurance is meant to protect your practice from financial losses resulting from the dishonest or criminal acts of one or more employees. You may also hear it referred to as Crime Insurance.

Employee dishonesty coverage can be purchased separately, but in many cases, it is bundled with other forms of insurance in a Business Owner’s Policy. (so chances are you already have basic coverage and may not know it)

I recommend practices have minimum employee dishonesty coverage equal to 5% of annual collections. If your practice collects $1,000,000 a year, then you need $50,000 in coverage.

Also, ask your insurance broker about claim expense coverage. This coverage is intended to help you offset the cost of a forensic audit to determine the amount of embezzlement losses in order to present your claim.

This is sometimes called a “professional fee endorsement.” Many policies do not include claim expense coverage, and for those that have it; the coverage amount is typically between $2,500 and $10,000. Since forensic audit and fraud examination fees are not inexpensive, I recommend your crime insurance have claim expense coverage of $5,000 to $10,000 (min)

Author: William Hiltz

William Hiltz BSc MBA CET is the CEO of Hiltz and Associates and the curator of Dental FraudBusters. Bill works exclusively for dentists in matters involving employee fraud, unethical business conduct, expert testimony, and litigation support.

Contact: william@hiltzandassociates.com

Visit: www.dentalfraudbusters.com

Resources:

On-Demand Embezzlement Course for Dentists (Free)

Dental Embezzlement Red Flag Self-Assessment (25+ red flags)

The Top 6 Dental Embezzlement Red Flags