A Costly Mistake: Relying on Checks for Claim Payments

For most dental practices, claim payments are their largest source of revenue

Given the volume involved and the disparate ways payments arrive, this can lead to unnoticed fraud and lost income.

Here are a few common ways this plays out.

Scenario 1:

Preston Endodontics had been serving the people of Harrisburg, PA for the last 12 years. Their office is in a quiet part of town.

A large number of Dr. Preston’s patients have dental insurance through Cappa Dental and like clockwork, the Cappa check arrives every Thursday. However, for the last 3 weeks it has not arrived. The first week, Dr. Preston thought it odd but did not pay it much attention.

When no check arrived again the second week he and his staff became alarmed and called Cappa. Cappa assured them the checks had been mailed. They also claimed that the first missing check had been deposited.

After checking his own bank account and assuring no check had been deposited for the week in question, Dr. Preston realized that he had been robbed out of his mailbox.

Scenario 2:

Mary had won the lottery! Well, her husband did and that meant she no longer had a need to work as office admin for Dr. Hema Singh.

Mary had been there for 15+ years and being in a smaller town, there weren’t a lot of options for hiring her replacement. Mary did help Dr. Singh find, interview and train Jessica. But while Dr. Singh had known and trusted Mary for years, she wasn’t sure how much she could trust someone she just met with her practice’s payment info, bank accounts and patient data.

Mary did not seem concerned, however, and gave her the keys to the kingdom. Dr. Singh tried to keep a close eye on the accounts until Jessica could gain her trust and sure enough she started noticing some smaller checks coming in that were never deposited to her account.

When she asked Jessica about them, she played ignorant. Dr. Singh called a forensic auditor and it was shortly revealed that sure enough, Jessica was altering the checks to deposit into her own account.

Scenario 3:

Stacy, the office manager for West Coast Dental, had quit 3 weeks ago and since then the practice started to struggle, financially. Stacy had trained Breanne for a month prior to leaving and Breanne was very capable. She seemed to pick everything up quickly but could not find why revenue had dropped off so much since Stacy left.

Then one day Breanne found it. Big Dental Co, one of the top 3 sources of revenue for West Coast Dental, was one of the payers that had been transitioned off of checks. These claim payments were now being paid as EFT (direct deposit) directly into the practice bank account, or at least should have been. As of 4 weeks ago, the payments stopped.

After talking to Big Dental Co, Breanne discovered that the bank account for claim payments had been changed to a different account Breanne and the practice owner were not familiar with.

Turns out that as a final good-bye, Stacy updated this information without telling anyone and had $53,000 deposited into her own bank account.

Scenario 4:

Dr. Huntington’s office was growing like crazy! Smiley Family Dentistry opened in a fast growing suburb of Austin, TX and in just 8 months they had a fully packed schedule and he was already considering bringing on an associate.

His office staff was young and inexperienced but competent with technology. He did not like to get in the weeds of the insurance billing, and the ledger showed continual revenue growth, so he was confident things were running smoothly.

Then one of his biggest payers, Southern Insurance, was calling repeatedly. The office staff said a rep from the payer was insistent he had to talk to the practice owner and they always called while he was meeting with patients.

Finally, during a rare break, the Southern Insurance rep called again and Dr. Huntington took the call. The rep was talking about a credit card payment and something about possible fraud but Dr. Huntington was not privy to the terms they were using. He gave them his personal email address and asked the rep to email him the details. Dr. Huntington then talked with a trusted dental consultant and forwarded to her the email to find out what was going on.

Turns out, one of the office staff was using their own payment account to deposit the virtual credit card payments that were coming from Southern Insurance. The office worker had skimmed over $20K over the course of 4 months.

The Fix

Unfortunately, all of these scenarios are real, though the names have been changed. The other common trait among these fraud scenarios is this: all of these are preventable by switching to EFT (direct deposit) claim payments and verification with the right software.

Checks and virtual credit cards are unsecure and outdated.

EFT is the only method of claim payment recommended by the ADA specifically because it is the safest, most efficient and fastest way for you to get paid.

Bad actors working inside or outside of your office cannot steal your checks if you are not getting paid with checks! Virtual credit cards (and their processing fees) disappear when you convert to EFT. C’mon, it’s 2025. Why are we still putting up with the checks and other paper-based payments?

Does EFT sound too complicated?

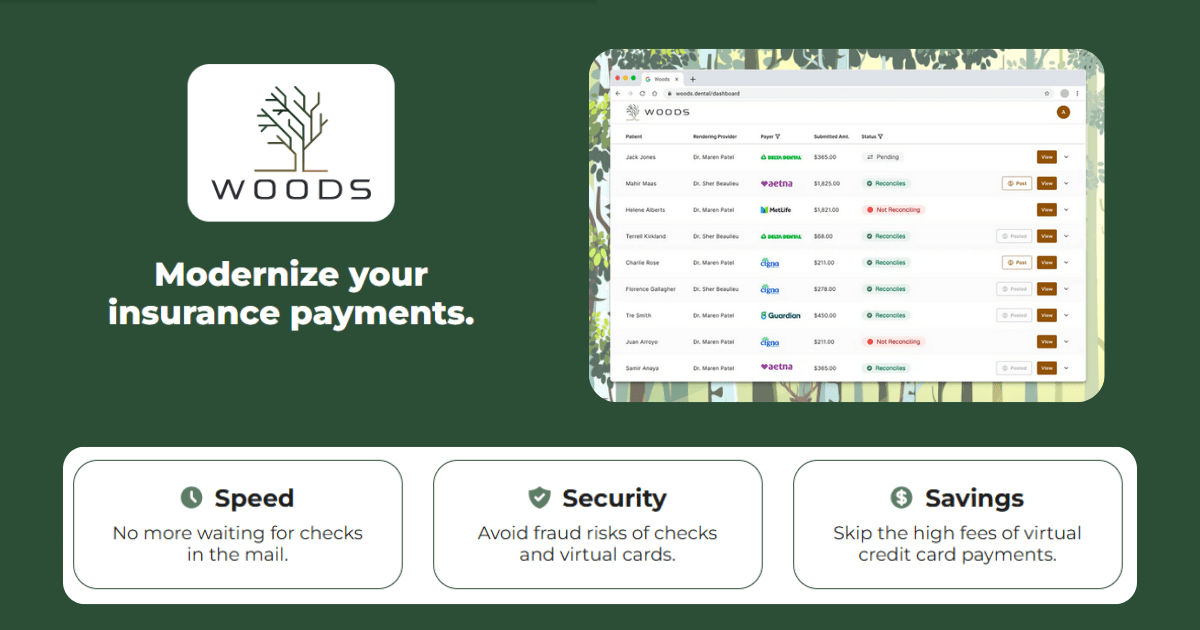

Is switching to EFT for all your payers is too daunting? Have you switched to EFT but fed up with logging into all those payer portals to track down EOBs? The team at Woods can help.

Woods is a unique platform that modernizes your claim payments.

Woods makes your switch to EFT seamless and monitors all digital payments and EOBs electronically. Let us bring your claim payments into the 21st century.

Consultants and Authors – Have something to say?

Did you know you can have your posts published here on Dental FraudBusters? Click the image below to learn more.